Finance

Who Is Responsible For Filing A Tax Return

Published: October 28, 2023

Learn about the responsibility of filing a tax return in finance. Understand who is accountable and ensure compliance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Tax Return Filing

- Individuals Responsible for Filing Tax Returns

- Responsibilities of Employed Individuals

- Responsibilities of Self-Employed Individuals

- Responsibilities of Married Couples

- Responsibilities of Dependent Individuals

- Responsibilities of Deceased Individuals

- Penalties for Not Filing Tax Returns

- Conclusion

Introduction

Filing a tax return is an essential responsibility for individuals and entities in many countries, including the United States. It is a process where taxpayers report their income, deductions, and credits to determine their tax liability or the refund they may be eligible for. However, the question arises, who is responsible for filing a tax return? Understanding this is crucial to ensure compliance with tax laws and avoid penalties.

In this article, we will provide an overview of tax return filing and delve into the responsibilities of different individuals, such as employed individuals, self-employed individuals, married couples, dependents, and deceased individuals. By clarifying these responsibilities, you will have a better understanding of who should file a tax return.

It is worth noting that tax laws and requirements may vary from one country to another, and it is always advisable to consult with a tax professional or refer to the relevant tax authority for specific guidelines applicable in your jurisdiction. With that said, let’s dive into the details of tax return filing responsibilities.

Overview of Tax Return Filing

Filing a tax return is a legal requirement in many countries and serves as a means for individuals and entities to report their income and fulfill their obligations towards the government. The process involves providing information such as income earned, deductions claimed, and credits requested, which ultimately determines the total tax liability or refund owed to the taxpayer.

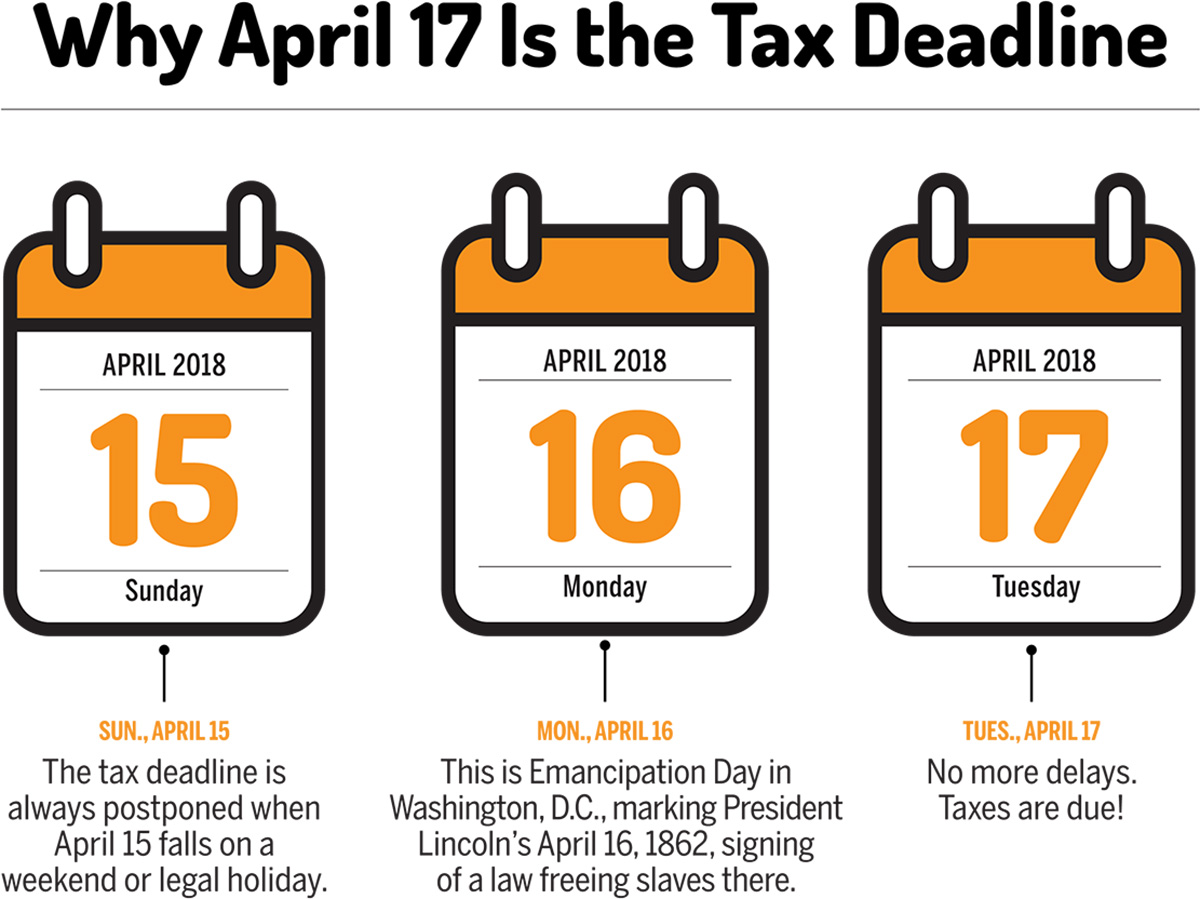

Typically, tax returns are filed annually, with a specific deadline set by the tax authority. In the United States, for example, individuals generally need to file their federal tax return by April 15th of the following year. It is important to file the tax return accurately and within the designated time frame to avoid penalties, as failure to comply can lead to fines and other legal consequences.

In addition to reporting income, tax returns also serve as an opportunity to claim deductions and credits that can reduce the overall tax liability. Deductions are expenses that individuals can subtract from their income, lowering the taxable amount. Common deductions include mortgage interest payments, medical expenses, and charitable contributions. On the other hand, tax credits are used to directly reduce the amount of tax owed and can vary depending on the individual’s circumstances, such as having children, pursuing higher education, or installing energy-efficient systems.

It is important to note that tax return filing requirements may vary depending on factors such as income level, marital status, and filing status. Certain individuals may be exempt from filing a tax return if their income falls below a certain threshold. However, even if you are not required to file a tax return, it can still be beneficial to do so, as you may be eligible for refunds or other tax benefits.

In the following sections, we will explore the specific responsibilities of different individuals when it comes to filing a tax return. Understanding these responsibilities is crucial to ensure compliance with tax laws and avoid unnecessary penalties.

Individuals Responsible for Filing Tax Returns

When it comes to filing tax returns, the responsibility falls on different individuals depending on their specific circumstances. Let’s take a closer look at who is generally responsible for filing a tax return.

1. Employed Individuals: If you are an employee and receive income from wages, salaries, tips, or any other compensation, you are typically responsible for filing a tax return. Your employer will provide you with a Form W-2, which shows your earnings and the taxes withheld throughout the year. This information is used to report your income accurately.

2. Self-employed Individuals: If you are self-employed or earn income through freelance work, independent contracting, or running a business, you are also responsible for filing a tax return. In addition to reporting your earnings, you will need to calculate and pay the appropriate self-employment taxes, including Social Security and Medicare taxes.

3. Married Couples: For married couples, the responsibility for filing a tax return depends on their marital status. If you are married and file your taxes jointly, both spouses are responsible for filing a tax return together. However, if you choose to file separately, each spouse is accountable for filing their own tax return.

4. Dependent Individuals: Dependents, such as children or other individuals who rely on someone else for financial support, may also have to file a tax return. The filing requirements for dependents are often determined based on their age, income level, and whether they have earned income or unearned income, such as interest or dividends.

5. Deceased Individuals: In the unfortunate event of an individual’s death, their estate or the executor of their estate may be responsible for filing a final tax return. This return covers the period from the start of the tax year until the date of the individual’s passing.

It’s important to note that tax laws and filing requirements may vary in different countries. Additionally, specific circumstances, such as receiving income from investments or rental properties, may also impact the responsibility for filing a tax return. Consulting with a tax professional or referring to the relevant tax authority’s guidelines can provide further clarification on your individual responsibilities.

Responsibilities of Employed Individuals

Employed individuals have specific responsibilities when it comes to filing a tax return. Here are some key aspects to consider:

1. Reporting Income: Employed individuals must accurately report all income earned from their job, including wages, salaries, tips, bonuses, and any other compensation. This information is obtained from the Form W-2, which is provided by the employer and includes details such as total earnings and taxes withheld.

2. Determining Filing Status: Employed individuals must determine their correct filing status, which can be single, married filing jointly, married filing separately, or head of household. The filing status impacts the tax rates, deductions, and credits available to the individual.

3. Claiming Deductions and Credits: Employed individuals can claim various deductions and credits to reduce their tax liability. Common deductions include student loan interest, mortgage interest, and medical expenses. Credits, such as the Earned Income Tax Credit or the Child Tax Credit, can also significantly reduce the amount owed.

4. Paying Income Taxes: While taxes are usually withheld from an employee’s paycheck throughout the year, it is important to ensure that the correct amount is being withheld. Employed individuals can adjust their withholding by completing Form W-4 provided by their employer, which helps to determine the appropriate amount of taxes to be withheld from each paycheck.

5. Filing the Tax Return: Employed individuals must file their tax return on time, typically by the deadline set by the tax authority. In the United States, the deadline is usually April 15th. Filing the tax return can be done electronically or by mail, depending on the preference of the taxpayer.

6. Reviewing the Tax Return: Before submitting the tax return, employed individuals should take the time to review it carefully for accuracy. Double-checking calculations, ensuring that all income is reported, and verifying the claimed deductions and credits can help prevent errors and potential audits.

It is important for employed individuals to keep accurate records of their income and any supporting documentation for deductions and credits. These records should be kept for a minimum of three to seven years, as they may be required for verification or in the event of an audit.

Seeking assistance from a tax professional or utilizing tax software can help employed individuals navigate the tax filing process efficiently and ensure that they fulfill their responsibilities accurately.

Responsibilities of Self-Employed Individuals

Self-employed individuals have unique responsibilities when it comes to filing a tax return. Here are some essential aspects to consider:

1. Reporting Income: Self-employed individuals must report all income they receive from their business activities. This includes income from freelancing, consulting, independent contracting, or running a small business. It is important to keep accurate records of all income earned throughout the year.

2. Estimated Tax Payments: Unlike employed individuals who have taxes withheld from their paychecks, self-employed individuals are typically responsible for making estimated tax payments throughout the year. These payments are used to cover their income tax liability and the self-employment tax, which includes the Social Security and Medicare taxes.

3. Self-Employment Taxes: Self-employed individuals must calculate and pay the appropriate self-employment taxes. This includes both the employer and employee portions of Social Security and Medicare taxes. The self-employment tax rate is higher than the regular payroll tax rate due to the absence of an employer contribution.

4. Deductions and Business Expenses: Self-employed individuals are entitled to deduct business expenses to reduce their taxable income. These deductions can include expenses such as office supplies, equipment, advertising, travel, and professional services. Keeping accurate records and retaining receipts is crucial for substantiating the legitimacy of these deductions.

5. Filing Schedule C or C-EZ: Self-employed individuals typically report their business income and expenses on Schedule C or C-EZ, which is attached to their individual tax return. Schedule C provides a detailed breakdown of income, deductions, and profit or loss from the business. Depending on the complexity of the business, self-employed individuals may seek the assistance of a tax professional to ensure accurate reporting.

6. Self-Employment Retirement Plans: Self-employed individuals are responsible for planning their own retirement and may consider setting up a self-employed retirement plan such as a SEP IRA or a Solo 401(k). These plans allow self-employed individuals to contribute money towards their retirement savings, providing tax advantages and helping secure their financial future.

It is crucial for self-employed individuals to keep meticulous records of their income, expenses, and any supporting documentation. This includes invoices, receipts, bank statements, and any other financial records related to the business. Accurate record-keeping is essential for substantiating deductions, responding to potential audits, and ensuring compliance with tax regulations.

Seeking the guidance of a tax professional who specializes in self-employment taxes can be beneficial. They can provide valuable advice on tax planning strategies, identify eligible deductions, and ensure that self-employed individuals meet all their tax filing responsibilities.

Responsibilities of Married Couples

Married couples have specific responsibilities when it comes to filing a tax return. Here are some key aspects to consider:

1. Filing Status: Married couples have the option to file their taxes jointly or separately. The filing status impacts the tax rates, deductions, and credits available to the couple. In most cases, filing jointly offers more tax benefits, but it is important to evaluate both options to determine which one is more advantageous based on your specific circumstances.

2. Combined Income and Deductions: When filing jointly, married couples must report their combined income from all sources. This includes wages, self-employment income, investment income, and any other earnings. Similarly, deductions and credits should be reported for both individuals to maximize tax benefits.

3. Picking the Appropriate Deductions: Married couples should carefully consider which deductions to claim on their tax return. They can choose between taking the standard deduction or itemizing their deductions. Itemized deductions can include expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses.

4. Responsibility for Accuracy: When filing jointly, both spouses are responsible for the accuracy of the tax return. This means that both individuals must review the return and ensure that all information is correct. If any errors or omissions are discovered later, both spouses may be held liable, even if only one individual was responsible for the mistake.

5. Consistency in Reporting: Married couples should ensure consistency in reporting their income and deductions for each tax year. It is important to report consistent information from year to year, especially when it comes to issues such as filing status, income reporting, or claiming specific tax credits.

6. Consideration of Separate Filing: In some cases, filing separately might be more beneficial for married couples. This can arise if one spouse has significant medical expenses or deductible business expenses, which would result in a larger tax benefit by filing separately. However, it is important to carefully evaluate the impact on overall tax liability before making this decision.

It is recommended that married couples consult with a tax professional or use tax software to assess the best filing status and determine the most advantageous approach for their specific circumstances. They can provide personalized advice and help navigate the complexities of the tax code to optimize tax savings.

Responsibilities of Dependent Individuals

Dependent individuals, such as children or individuals who rely on someone else for financial support, may also have responsibilities when it comes to filing a tax return. Here are some important aspects to consider:

1. Filing Threshold: Dependent individuals need to determine if they meet the filing threshold set by the tax authority. The threshold is based on factors such as age, income level, and filing status. If the dependent’s income exceeds the threshold, they are required to file a tax return.

2. Reporting Income: Dependent individuals must accurately report all income earned during the tax year. This includes wages, tips, interest, dividends, and any other form of earned income. It is important to keep all relevant documents, such as Form W-2 or 1099, to report income accurately.

3. Unearned Income: Dependent individuals may have unearned income, such as interest, dividends, or capital gains. The tax treatment of unearned income depends on various factors, including the type of income and the amount earned. Some types of unearned income may be subject to special tax rules or rates.

4. Education Credits: Dependent individuals who are pursuing higher education may be eligible for education tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit. These credits can help offset the cost of tuition and other qualified educational expenses. It is important to understand the eligibility criteria and claim the appropriate credits on their tax return.

5. Dependency Exemption: If a dependent individual meets the requirements to be claimed as a dependent on someone else’s tax return, they cannot claim a personal exemption on their own tax return. The individual who claims the dependent is entitled to the exemption, providing some tax relief for supporting the dependent financially.

6. Filing Status: Dependent individuals must determine their correct filing status based on their specific situation. In most cases, dependents file as “Single” if they are unmarried, have no dependents of their own, and do not qualify for any other filing status. However, in certain circumstances, a dependent individual may qualify for a different filing status, such as “Head of Household.”

It is important for dependent individuals to understand their specific tax obligations and consult with a tax professional or refer to the relevant tax authority’s guidelines if needed. While dependent individuals may have less complex tax situations, it is still crucial to fulfill their responsibilities to ensure compliance with tax laws.

Responsibilities of Deceased Individuals

In the unfortunate event of an individual’s death, there are still responsibilities that need to be fulfilled when it comes to filing a tax return. Here are some important aspects to consider:

1. Final Tax Return: The executor of the deceased individual’s estate or the surviving spouse, if applicable, is responsible for filing the final tax return. This return covers the period from the beginning of the tax year until the date of the individual’s passing. The tax return should be filed using the same filing status the deceased individual would have used if they were still alive.

2. Reporting Income: The final tax return should accurately report the deceased individual’s income for the final year. This includes income earned from wages, investments, retirement accounts, or any other sources of income. Any necessary tax forms, such as Form W-2 or 1099, should be obtained to report income accurately.

3. Estate Tax: Depending on the value of the deceased individual’s estate, there may be additional estate tax obligations. It is important to consult with a tax professional or an attorney experienced in estate planning to determine if estate tax filings are required and to manage any potential estate tax liabilities.

4. Filing Deadlines: The deadline for filing the final tax return of a deceased individual is typically the same as for living taxpayers. However, extensions may be available in certain circumstances, and it is advisable to consult with a tax professional or refer to the relevant tax authority’s guidelines to ensure compliance with filing deadlines.

5. Estate Administration: The executor of the deceased individual’s estate is responsible for managing the financial affairs of the estate, which may include paying any outstanding taxes owed. This may involve liquidating assets, distributing funds to beneficiaries, and addressing any outstanding tax matters related to the deceased individual.

6. Inheritance Taxes: In some jurisdictions, there may be inheritance taxes levied on the assets transferred from the deceased individual’s estate to their beneficiaries. It is important to consult with a tax professional or an attorney to understand the potential impact of inheritance taxes and navigate the necessary filings.

Dealing with the tax responsibilities of a deceased individual can be complex and emotionally challenging. It is advisable to seek the assistance of a tax professional, an attorney, or an estate planning expert who can provide guidance and support in fulfilling these responsibilities accurately and efficiently.

Penalties for Not Filing Tax Returns

Failing to file tax returns can have serious consequences, including financial penalties and legal ramifications. It is crucial for taxpayers to understand the potential penalties in order to fulfill their tax filing responsibilities. Here are some important points to consider:

1. Late Filing Penalties: If you fail to file your tax return by the deadline set by the tax authority, you will likely incur a late filing penalty. The penalty amount varies depending on the jurisdiction and the length of the delay. It is important to note that the penalty continues to increase the longer the return remains unfiled.

2. Failure to Pay Penalties: In addition to the late filing penalty, if you owe taxes and do not pay the amount owed by the deadline, you may face a failure to pay penalty. This penalty is typically a percentage of the unpaid tax amount and can accumulate over time until the balance is paid in full.

3. Interest on Unpaid Taxes: If you do not file your tax return or pay your taxes on time, interest will also be charged on the unpaid amount. The interest rate is usually determined by the tax authority and accrues daily until the tax debt is fully resolved.

4. Denial of Refunds and Credits: Failing to file a tax return can result in the denial of any tax refunds or credits that you may be eligible for. This means that you will not receive any money owed to you by the tax authority, creating a financial disadvantage.

5. Audit and Investigation: Not filing tax returns can increase the likelihood of being selected for an audit or investigation by the tax authority. If the tax authority suspects non-compliance or fraudulent activity, they may conduct a thorough examination of your financial records, leading to potential fines, penalties, or legal consequences.

6. Criminal Charges: In severe cases, deliberately failing to file tax returns can result in criminal charges. Engaging in tax evasion or willfully evading tax responsibilities can lead to prosecution, fines, and even imprisonment. It is essential to understand that intentionally avoiding tax obligations is a serious offense that can have long-term consequences.

It is important to note that the specific penalties for not filing tax returns may vary from one country to another. It is always recommended to consult with a tax professional or refer to the guidelines of the relevant tax authority to understand the specific penalties applicable in your jurisdiction.

Fulfilling your tax filing responsibilities on time not only helps you avoid penalties and legal issues but also ensures compliance with tax laws, maintains your financial reputation, and contributes to the overall functioning of the tax system.

Conclusion

Filing a tax return is an important responsibility that individuals and entities must fulfill. Understanding who is responsible for filing a tax return is crucial to ensure compliance with tax laws and avoid penalties. Throughout this article, we have explored the responsibilities of different individuals, including employed individuals, self-employed individuals, married couples, dependent individuals, and deceased individuals.

Employed individuals have the responsibility to accurately report their income, claim deductions and credits, and file their tax return on time. Self-employed individuals have additional responsibilities, such as making estimated tax payments, calculating self-employment taxes, and deducting appropriate business expenses.

Married couples must carefully choose their filing status, report combined income and deductions, and ensure consistency in reporting. Dependent individuals need to determine their filing threshold, report income accurately, and consider credits and deductions available to them. For deceased individuals, their estate or the executor is responsible for filing a final tax return, reporting income until the date of passing, and addressing any estate tax obligations.

Failure to fulfill tax filing responsibilities can result in penalties, including late filing penalties, failure to pay penalties, denial of refunds or credits, and interest charges on unpaid taxes. In severe cases, criminal charges and legal consequences may arise.

To navigate the complexities of tax return filing and ensure compliance, it is recommended to consult with a tax professional or utilize tax software. These resources can provide tailored guidance based on individual circumstances, maximize tax benefits, and minimize the risk of penalties or legal issues.

Ultimately, fulfilling tax filing responsibilities contributes to the smooth functioning of the tax system, maintains financial integrity, and allows individuals and entities to meet their obligations towards the government. By staying informed and proactive in our tax obligations, we can navigate the tax landscape confidently and efficiently.